Get the free ct 6 instructions form

Show details

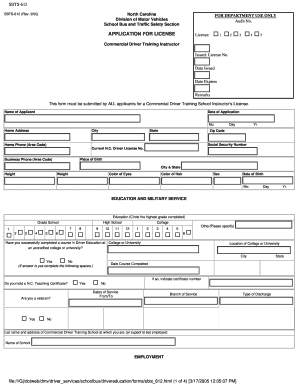

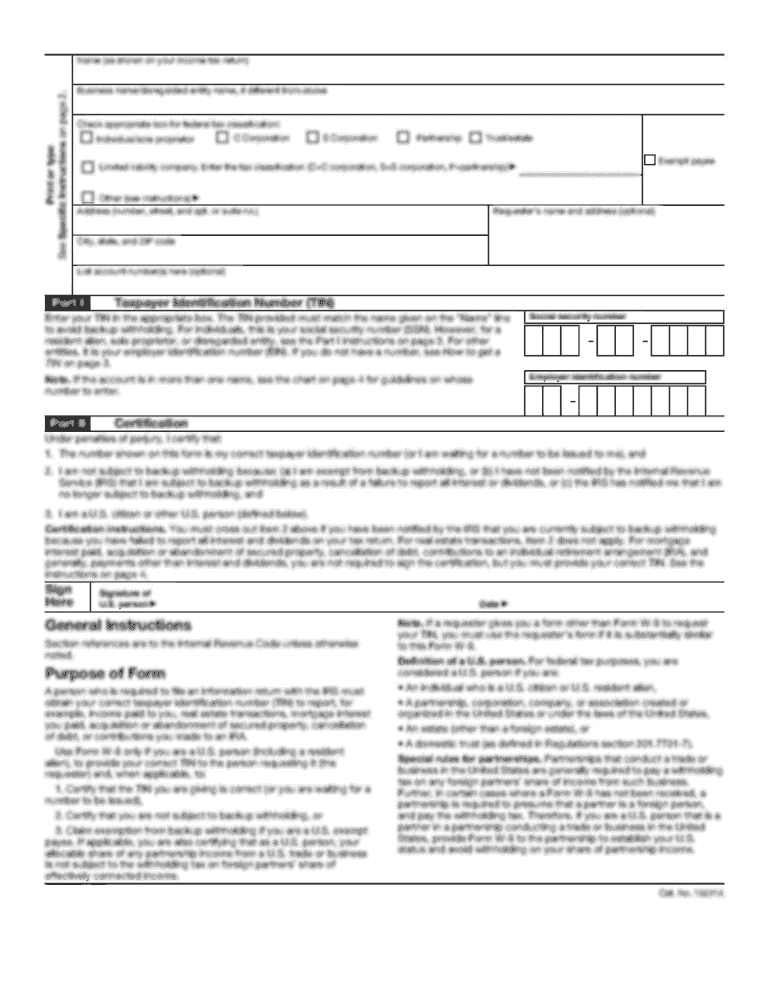

New York State Department of Taxation and Finance Instructions for Form CT-6 Election by a Federal S Corporation to be Treated as a New York S Corporation CT-6-I (7/96) General Information A federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct 6 instructions form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 6 instructions form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 6 instructions online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ny ct 6 instructions form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out ct 6 instructions form

How to fill out form ct 6 instructions:

01

Start by reading the instructions provided with the form. These instructions will guide you through the process of completing form ct 6 accurately.

02

Enter your personal information, including your full name, address, and contact details. Make sure to provide accurate and up-to-date information.

03

Fill out the required fields on the form, such as your taxpayer identification number, business details, and any applicable credits or deductions.

04

Double-check your entries for any errors or omissions. It's important to ensure the information you provide is correct to avoid any delays or issues with the form.

05

Attach any necessary supporting documentation as instructed. This may include financial statements, receipts, or other relevant records.

06

Review the completed form for accuracy and completeness before submitting it to the appropriate authority. It's a good idea to keep a copy of the form and any supporting documents for your records.

Who needs form ct 6 instructions:

01

Individuals or businesses required to file Connecticut state taxes may need form ct 6 instructions. This form is specifically used to report the Sales and Use Tax Liability.

02

If you are engaged in selling taxable goods or services in Connecticut, you will need to complete form ct 6 to report your sales tax liability accurately.

03

Additionally, businesses that have made certain purchases subject to use tax may also need to fill out form ct 6 to report their use tax liability.

It's important to note that the specific requirements and circumstances for needing form ct 6 instructions may vary depending on your individual or business situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form ct 6 instructions?

Form CT-6 is a New York State Department of Taxation and Finance form used for the filing of the Article 9-A Combined Franchise Tax Return for corporations. The instructions for Form CT-6 provide guidance on how to complete the form, including information on who should file, how to calculate taxable income, and various other requirements and considerations for filing the return. The instructions also provide details on how to report income from different sources, deductions, credits, and other relevant tax information for corporations subject to the New York State franchise tax.

Who is required to file form ct 6 instructions?

In the context of taxation, Form CT-6 is used by corporations and partnerships subject to the Connecticut corporation business tax. Therefore, corporations and partnerships registered or doing business in Connecticut are required to file Form CT-6. The instructions for filing the form can be found on the Connecticut Department of Revenue Services (DRS) website or in the official instructions document provided by the DRS. It is advisable to consult with a tax professional or refer to the official instructions for specific guidelines on filing Form CT-6.

When is the deadline to file form ct 6 instructions in 2023?

As of now, I cannot provide any information on the deadline to file form CT 6 instructions in 2023 as the specific dates for tax filing deadlines are determined by the tax authorities and are generally announced closer to the tax year. It is recommended to consult the official tax agency or visit their website for the most up-to-date and accurate information on filing deadlines.

What is the purpose of form ct 6 instructions?

Form CT-6 instructions provide guidance to taxpayers on how to complete and file Form CT-6, also known as the Application for Extension of Time to File Connecticut Corporation Tax Return. This form is used by corporations in Connecticut to request an extension of time to file their corporate tax return.

The purpose of the instructions is to provide information and explanations about various sections and requirements of Form CT-6. The instructions outline who should file the form, when and how to file it, and provide detailed instructions on completing each section of the form.

The instructions also provide information on any supporting documents or schedules that may need to be attached to the form, as well as the deadline for submitting the form and any penalties for late filing.

Overall, the purpose of Form CT-6 instructions is to assist taxpayers in accurately and efficiently completing the extension request form and ensuring compliance with Connecticut corporate tax laws.

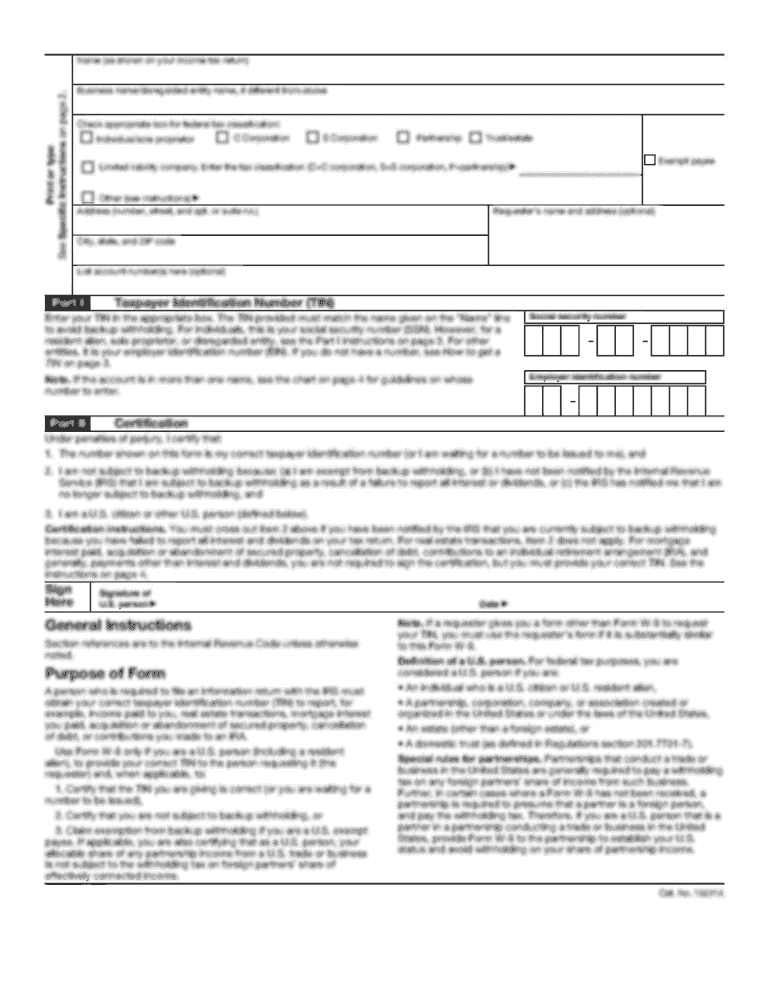

What information must be reported on form ct 6 instructions?

Form CT-6 is used by taxpayers to report the net Connecticut income tax liability. The instructions for this form provide guidance on what information needs to be reported. Here are the key details that must be reported on Form CT-6:

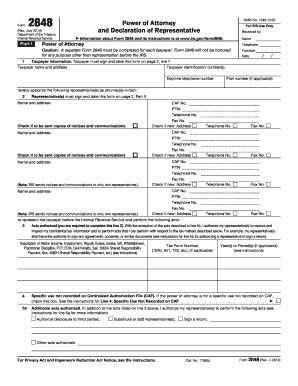

1. Taxpayer Information: Provide the taxpayer's legal name, address, federal employer identification number (FEIN), and business identification number (BIN).

2. Net Connecticut Income Tax Liability: Calculate the taxpayer's net Connecticut income tax liability based on the applicable tax rate schedule or alternate tax calculation, if applicable.

3. Apportioned Income: Report the apportioned income for purposes of calculating the net Connecticut income tax liability. This includes income earned both within and outside of Connecticut, which may require the use of different apportionment formulas depending on the nature of the taxpayer's business.

4. Credits: Report any applicable credits that the taxpayer is eligible for, such as investment credits, job expansion credits, research and development credits, or any other allowable credits.

5. Additions or Subtractions: Report any additional income or subtractions that are required to compute the Connecticut net income tax liability. This may include adjustments for federal limitations, special deductions, or other modifications.

6. Connecticut Tax Calculation: Calculate the total Connecticut income tax liability by subtracting any credits or subtractions from the net Connecticut income tax liability determined in step 2.

7. Payments and Refunds: Report any estimated tax payments, extensions, or other credits from the prior year that should be applied against the current year's tax liability. Also, report any overpayments that should be refunded or applied to future tax liabilities.

8. Signature: Sign and date the form to certify the accuracy of the information provided.

It's important to consult the specific instructions provided with Form CT-6 for complete guidance and to ensure compliance with current tax laws and regulations.

What is the penalty for the late filing of form ct 6 instructions?

The penalty for the late filing of Form CT-6, which is used to report an S Corporation's New York State tax information, is as follows:

1. Late Filing Fee: There is a late filing fee of $50 for each month, or part of a month, that the return is late, up to a maximum of $500.

2. Failure to File Penalty: In addition to the late filing fee, if the return is not filed within 60 days from the due date, there is also a failure to file penalty. The penalty is the greater of $50 or 5% of the tax due for each month, or part of a month, that the return remains unfiled, up to a maximum of 25% of the tax due.

It is important to note that penalties and interest may vary depending on the specific circumstances, and it is advisable to consult the official instructions or a tax professional for accurate and up-to-date information.

How to fill out form ct 6 instructions?

To fill out form CT-6 (Connecticut Annual Limited Liability Company Tax Return), follow these instructions:

1. Identification section: Provide the following information:

- Enter the LLC's legal name and federal employer identification number (FEIN).

- Indicate whether the LLC is a single-member or multi-member LLC.

- Provide the LLC's mailing address and the name and phone number of the contact person.

2. Tax year information: Enter the beginning and ending dates of the tax year for which you are filing the return.

3. Apportionment factor information:

- If your LLC has income from business activities in multiple states, you need to determine the apportionment factor by completing Schedule A.

- Provide the total amounts for property, payroll, and sales/income both in Connecticut and outside Connecticut. Calculate the apportionment percentages for each factor based on the provided formulas.

4. Calculation of tax liability:

- Use Schedule C to calculate the tax on the LLC's net income derived from Connecticut sources.

- Enter the LLC's total income from Connecticut sources and calculate the income tax using the provided tax rate schedule.

- Deduct the non-refundable Business Entity Tax (if applicable) from the calculated tax.

5. Credits and payments:

- Enter any credits that your LLC is eligible for on Schedule D. These may include tax credits for job creation or certain research activities.

- Fill out Schedule M-1 to reconcile any differences between accounting net income and taxable income.

6. Signature and payment:

- The return must be signed by a responsible party on behalf of the LLC.

- Make sure the preparation date, preparer's name, address, and signature are included.

- Attach any necessary supporting schedules and payment to the return.

7. Filing the return:

- Mail the completed form CT-6 and accompanying payment (if applicable) to the address provided on the form.

- Retain a copy of the return and all supporting documentation for your records.

Note: These instructions provide a general overview. Always refer to the official instructions provided by the Connecticut Department of Revenue Services for detailed information and specific requirements related to form CT-6.

Can I sign the ct 6 instructions electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ny ct 6 instructions form in seconds.

Can I create an electronic signature for signing my ct 6 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your ct 6 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete ct 6 instructions 2019 on an Android device?

Use the pdfFiller mobile app to complete your form ct 6 instructions on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your ct 6 instructions form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 6 Form is not the form you're looking for?Search for another form here.

Keywords relevant to form ct 6

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.